These cookies cannot be disabled. They are essential for core functionality in ebrd.com to ensure a seamless and secure experience.

EBRD-WB BEEPS

This short summary provides an overview of the results of the fifth EBRD and World Bank Business Environment and Enterprise Performance Survey (BEEPS V) from across the transition region.

An overview of business environment obstacles in each of 29 countries can be found here, while country-specific results are available below. The country-specific pages also cover Cyprus and Greece, where the BEEPS V survey was completed in 2016.

Joint WBG-EBRD-EIB MENA Enterprise Surveys

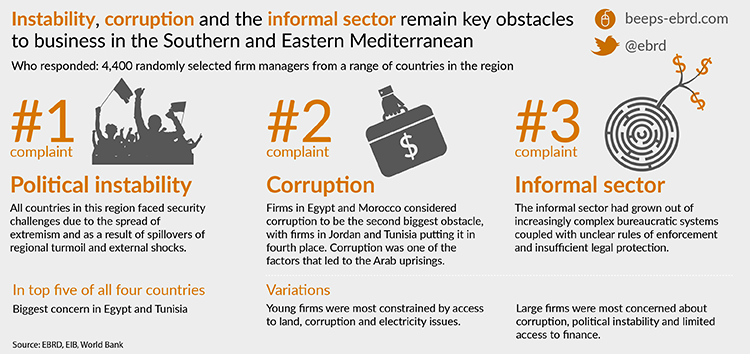

These new surveys conducted by the EBRD, the World Bank Group and the European Investment Bank in SEMED as well as in Djibouti, Israel, Lebanon, West Bank and Gaza and Yemen, are based on interviews with more than 6,500 randomly selected firm managers from a range of countries in the region.

The EBRD’s analysis focuses on the four countries where the Bank works in the EBRD’s southern and eastern Mediterranean (SEMED) region – Jordan, Egypt, Morocco and Tunisia – where more than 4,400 firm managers were interviewed.