Who we are

Overview: about the EBRDWho we are

Overview: about the EBRD

Our story

Learn about the EBRD's journey to investing more than €220 billion in over 7,800 projects.

- Our background and history

- Our organisation

- Our values

- Strategies, governance and compliance

- Project accountability

What we do

Overview: how the EBRD operatesWhat we do

Overview: how the EBRD operates

How we deliver systemic impact

Across three continents, the EBRD supports the transition to successful market economies.

- Where we work

- Products and services

- Sectors we work in

- Our projects

- Focus areas and initiatives

- Economic research

Work with us

Overview: how you can work with the EBRDWork with us

Overview: how you can work with the EBRD

What we offer for businesses

We draw on three decades of regional knowledge and financial expertise to tailor our products and approaches to each client's needs.

- Businesses

- Investors

- Donors

- Researchers

- Civil Society

- Alumni

- Nominee Directors

- Trade finance

- Careers

Moving the needle? The EBRD in Uzbekistan (2017-22)

October, 2023

Introducing country-level evaluations

EvD is introducing country-level evaluations to provide a new perspective on how the EBRD contributes to systemic change. Systemic change is an important part of how the EBRD contributes to its strategic objectives but is not clearly visible in the Bank’s project-level monitoring systems. Countries are the unit of reference and accountability for the Bank’s transition mandate hence the criticality of reporting at country level.

This pilot country-level evaluation examines EBRD operations in Uzbekistan, covering the period 2017-22. Uzbekistan was selected based on the timing of the next country strategy (CS)and the size of EBRD operations, which makes examining systemic change more feasible.

The evaluation takes a theory-based approach. The focus is understanding the contribution towards systemic changerather than attributing change to the Bank’s activities.

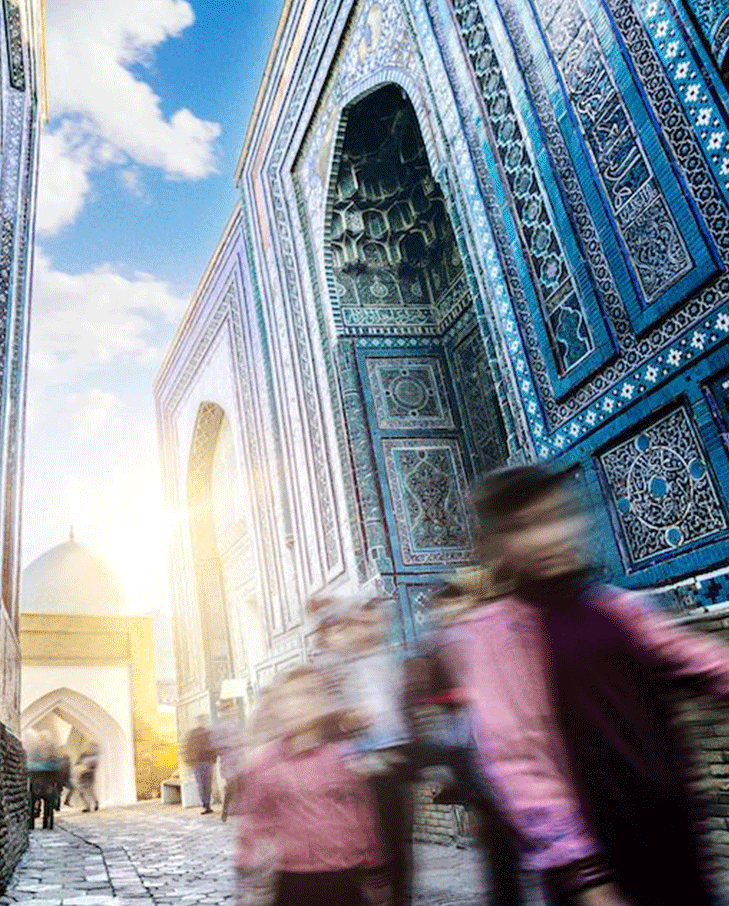

Uzbekistan – a country transforming

The period covered under this evaluation, 2017-22, marks a period of significant change for Uzbekistan. President Shavkat Mirziyoyev, who took office in December 2016, has implemented a far reaching reform agenda, which has included the liberalisation of the exchange rate and opening key sectors of the economy to private sector participation and international investment. Uzbekistan has also had to navigate the global challenges of the COVID-19 pandemic and the Russian war on Ukraine, which have had adverse economic consequences and have increased uncertainty.

This time span is also significant with respect to the role of the EBRD in Uzbekistan. The EBRD re-started operations in Uzbekistan in 2017 after a hiatus of several years in which it had no permanent presence in-country. This period is also one of substantial institutional change, with the re-establishment of the Uzbekistan Regional Office (RO) and the growth of the in country team from 5 members in 2017 to nearly 50 today. This provides a unique opportunity to assess the EBRD’s contribution to a country, but also presents challenges given the limited maturity of much of the Bank’s portfolio.