Who we are

Overview: about the EBRDWho we are

Overview: about the EBRD

Our story

Learn about the EBRD's journey to investing more than €220 billion in over 7,800 projects.

- Our background and history

- Our organisation

- Our values

- Strategies, governance and compliance

- Project accountability

What we do

Overview: how the EBRD operatesWhat we do

Overview: how the EBRD operates

How we deliver systemic impact

Across three continents, the EBRD supports the transition to successful market economies.

- Where we work

- Products and services

- Sectors we work in

- Our projects

- Focus areas and initiatives

- Economic research

Work with us

Overview: how you can work with the EBRDWork with us

Overview: how you can work with the EBRD

What we offer for businesses

We draw on three decades of regional knowledge and financial expertise to tailor our products and approaches to each client's needs.

- Businesses

- Investors

- Donors

- Researchers

- Civil Society

- Alumni

- Nominee Directors

- Trade finance

- Careers

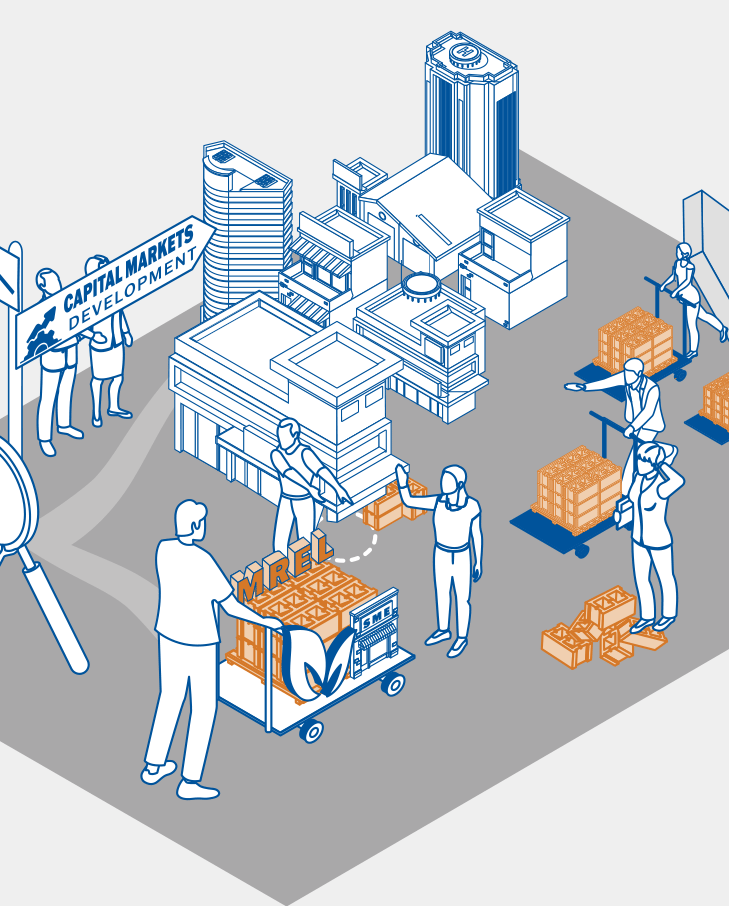

“Forging Resilience” An Evaluation of the Transition Impact and Additionality of the EBRD’s MREL & Bail-in-able Products [2016-2023]

July, 2024

The introduction of MREL and bail-in-able products has created new opportunities for Multilateral Development Banks (MDBs), but it has also raised questions regarding the role MDBs should play in utilizing MREL and bail-in products to support their countries of operations.

Minimum-Requirement-for-Own-Fundsand-Eligible-Liabilities (MREL) instruments have become a key component in the capital structures of banks within the European Union, as a result of regulations set by the 2014 Bank Recovery and Resolution Directive (BRRD).

For the EBRD, MREL and bail-in products have rapidly become significant business; over the period covered by this evaluation, between 2016 and endSeptember 2023, the Bank invested in 95 separate MREL and bail-in instruments across 15 countries, with a total investment of EUR 3.1bn.

This evaluation responds to requests from Board Directors to better understand the role of the EBRD in the market for MREL and bail-in instruments, focusing specifically on the additionality and the EBRD’s contribution towards transition impact. It is the first evaluation of an MDB’s intervention in MREL and bail-in instruments. The evaluation draws upon an extensive portfolio analysis, case studies of the Bank’s investments in Romania, Jordan, and Poland, and wider contextual stocktaking of the market for MREL and bail-in instruments.

It is critical to understand how MREL and bail-in instruments may foster transition and drive systemic change.