Who we are

Overview: about the EBRDWho we are

Overview: about the EBRD

Our story

Learn about the EBRD's journey to investing more than €220 billion in over 7,800 projects.

- Our background and history

- Our organisation

- Our values

- Strategies, governance and compliance

- Project accountability

What we do

Overview: how the EBRD operatesWhat we do

Overview: how the EBRD operates

How we deliver systemic impact

Across three continents, the EBRD supports the transition to successful market economies.

- Where we work

- Products and services

- Sectors we work in

- Our projects

- Focus areas and initiatives

- Economic research

Work with us

Overview: how you can work with the EBRDWork with us

Overview: how you can work with the EBRD

What we offer for businesses

We draw on three decades of regional knowledge and financial expertise to tailor our products and approaches to each client's needs.

- Businesses

- Investors

- Donors

- Researchers

- Civil Society

- Alumni

- Nominee Directors

- Trade finance

- Careers

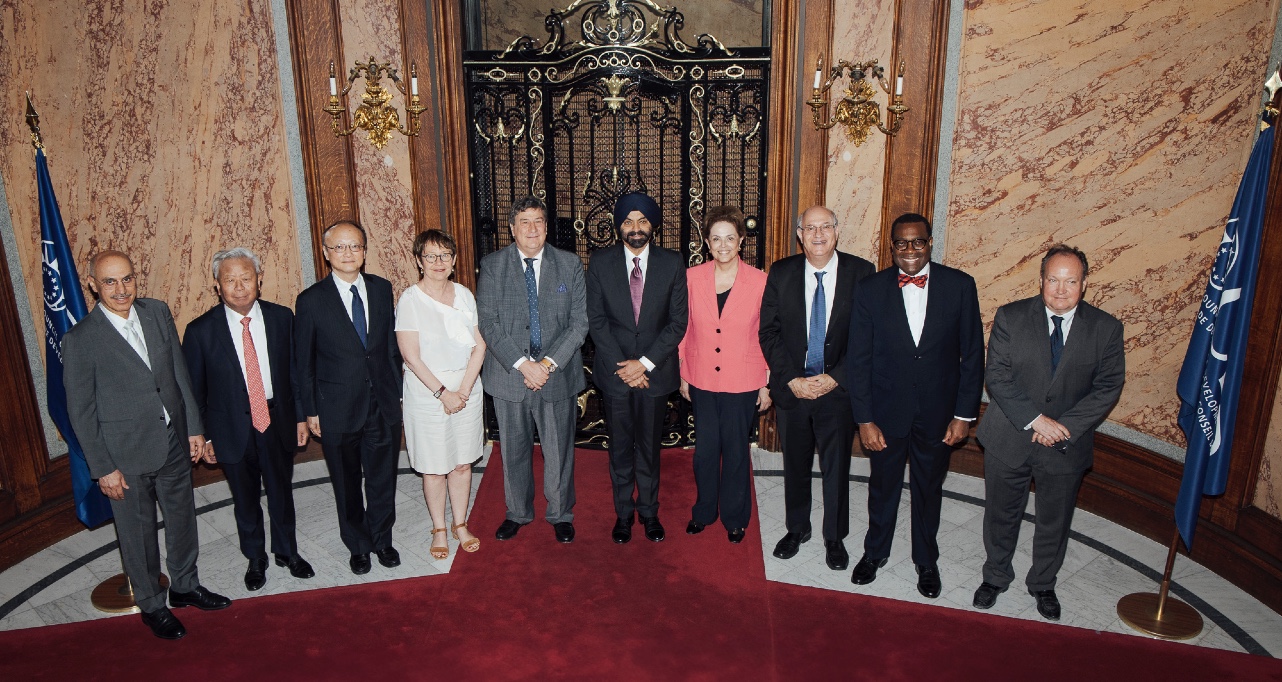

The Heads of Multilateral Development Banks (MDBs) met yesterday in Paris, hosted by the Council of Europe Development Bank (CEB), which currently chairs the Heads of MDBs Group. The meeting focussed on advancing their joint efforts to address development priorities.

Amid rising global uncertainty, the Heads reaffirmed their commitment to working as a system to deliver greater impact and scale, in line with their Viewpoint Note and the recommendations of the G20 Roadmap towards Better, Bigger, and More Effective MDBs.

The Roadmap outlines an ambitious vision for MDB reform to better address regional and global challenges, support job creation, and help countries achieve their development aspirations.

The Heads welcomed ongoing efforts to improve the way MDBs work with clients through operational efficiency and enhanced coordination. In 2025 alone, five mutual reliance agreements have been signed, helping streamline the preparation and implementation of co-financed projects across institutions.

Private capital mobilisation remains a system-wide priority, with the last joint report of the MDBs reflecting a positive trend in volumes mobilised. To build on this momentum, the Heads reaffirmed their commitment to developing local currency lending and foreign exchange solutions.

They also reaffirmed the importance of adequate risk assessment for private sector investment in emerging markets and developing economies; in this context, the valuable contribution of disaggregated statistics on credit risk published through the Global Emerging Markets Risk Database (GEMs) was recognized.

The Heads reiterated their continued commitment to implementing the recommendations of the G20 Independent Review of Multilateral Development Banks’ Capital Adequacy Frameworks (CAF). Further reform efforts by MDBs since mid-2024 have increased the additional lending headroom for development projects in all countries of operation, including high-income ones, over the next decade by more than US$250 billion, thus reaching a total of over US$650 billion.

The publication in the coming weeks of the Comparison Report by the MDBs’ Global Risk and Finance Forum (GRaFF) will provide metrics and data relating to MDBs’ financial positions, promoting a better understanding of their financial models and supporting both balance sheet optimisation and private sector mobilisation.

The Heads also agreed to continue advancing promising initiatives already underway to strengthen system-wide impact. These include:

1) Mission 300, which aims to connect 300 million people in Africa to electricity by 2030 through public and private collaboration;

2) Association of South East Asian Nations (ASEAN) Power Grid, which aims to boost energy security, strengthen resilience, and promote decarbonization for the region’s 670 million people by connecting its electricity systems;

3) Digital Transformation in Education in Latin America and the Caribbean, which aims to connect 3.5 million students and train over 250,000 teachers.

In addition, MDBs are exploring joint actions to scale up investments in social infrastructure, including health, education, housing, and water and sanitation. Building on structured dialogue led by the CEB, the Heads welcomed progress made through recent cross-MDB consultations and recognized the key role these sectors play in enabling jobs, productivity, and inclusive growth, while noting persistent financing and delivery challenges that constrain impact.

Meeting in advance of the Fourth International Conference on Financing for Development (FfD4), which will take place in Seville, Spain, from 30 June to 3 July, MDBs remain committed to working better as a system, in alignment with country-led development priorities and strategies to promote jobs and prosperity.

In view of water’s role in human development, MDBs committed to significantly increasing collective support for global water security by 2030, and will launch the first “Joint Annual MDB Water Security Financing Report” at FfD4. Heads noted the importance of the upcoming COP30 in Belem, Brazil, in November 2025.

Yesterday’s meeting in Paris marked a significant step toward effective collaboration and scaled-up collective action for development priorities. MDB reforms are advancing, moving from concept to execution.

With streamlined operations, better risk tools, and growing financial capacity, MDBs are delivering real impact – from expanding energy access and digital education to scaling investment in water security.